If you’ve been shopping for a graphics card lately, you’ve probably experienced sticker shock. Prices seem to climb higher every month, leaving gamers and professionals wondering what’s going on.

You’re not alone in this frustration. Millions of people are asking the same question: why do graphics cards cost so much? In this article, we’ll break down the real reasons behind these high prices. We’ll cover supply chain issues, manufacturing costs, market demand, and cryptocurrency impact.

I’ve spent years researching the tech industry and tracking GPU prices. My goal is to give you straight answers without the marketing fluff.

By the end of this piece, you’ll understand exactly why your dream graphics card costs what it does. More importantly, you’ll know when prices might drop and how to find better deals. Let’s get into the facts that matter.

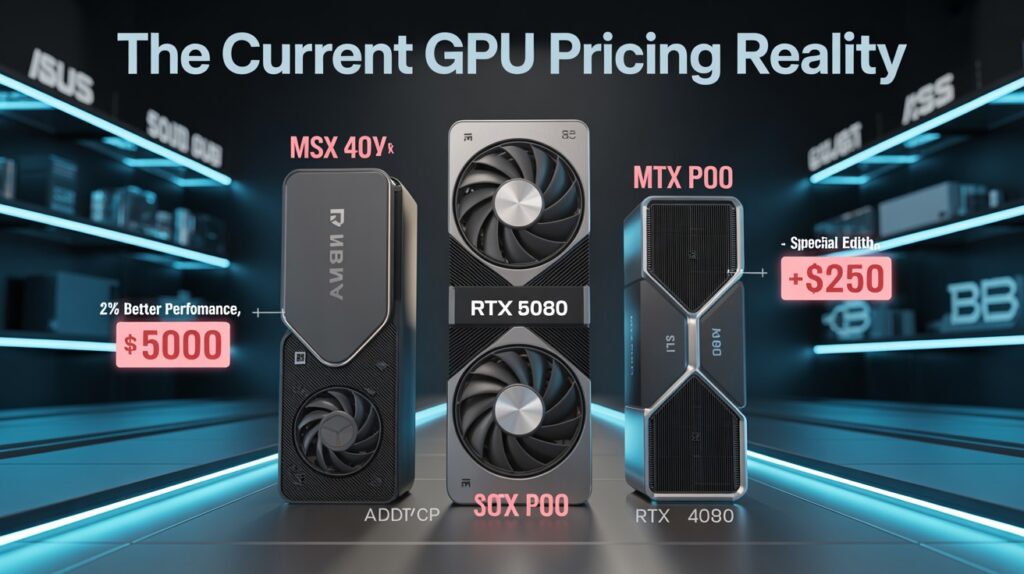

The Current GPU Pricing Reality

Let me show you what’s happening with graphics card prices right now.

MSRP vs Actual Market Prices

Here’s the truth nobody talks about: MSRP means nothing in today’s market.

Companies announce these nice, clean prices. Then you go to buy the card. Good luck finding it at that price.

This is what I call the “retail price lie.” Here are the real numbers:

- AMD RX 9070 XT: $599 MSRP vs. $839+ actual price

- RTX 5080: $999 MSRP vs. $1,359 actual price

- RTX 4090: $1,599 at launch vs. $2,819 current price

Think about that last one. The RTX 4090 costs $1,220 more than when it first came out.

New cards sell out in minutes. Then they reappear with $150-250 markups. Sometimes more.

The AIB Partner Markup System

Here’s where things get sneaky.

Companies like ASUS, MSI, and Gigabyte take the base cards. They add fancy cooling systems. Maybe some RGB lights. Then they jack up the price.

They call them “special editions.” But the performance boost? Barely noticeable.

Take the XFX RX 9070 XT example. They added magnetic fans. 40% price increase for that feature.

Or look at MSI’s Suprim RTX 5090. You pay a $500 premium for 2% better performance. That’s $250 for each percentage point of improvement.

AI Demand and Market Prioritization

Do you want to know why your gaming GPU costs so much? AI companies are outbidding you.

Enterprise Market Takes Priority

Here’s what’s happening behind the scenes.

Data centers pay way more for the same chips. We’re talking about profit margins that are 10 times higher than gaming cards. If you run a business, which customer would you choose?

The numbers tell the story:

- 70 %+ of GPU manufacturing goes to AI companies

- Data centers get first pick of new chips

- Gaming cards are made with whatever’s left over

- Enterprise customers pay premium prices without complaining

Gaming used to be the main market. Not anymore.

Resource Allocation Shift

This gets worse when you look at chip production.

TSMC makes the processors for most graphics cards. They have limited factory space. AI chips get priority because they’re more profitable.

Here’s how it works:

- Best quality chips → Enterprise AI cards

- Medium quality chips → High-end gaming cards

- Lower quality chips → Budget gaming cards

You’re getting the leftovers. But paying premium prices.

Even worse? Companies spend their research money on AI features now. Gaming performance improvements? Secondary concern.

The message is clear: AI pays better than gamers.

Manufacturing and Supply Chain Costs

Advanced Technology Expenses

- Cutting-edge TSMC node costs (5nm, 4nm processes)

- Limited global fab capacity for modern GPU manufacturing

- R&D expenses for new architectures (Blackwell, RDNA 4)

- Complex packaging and high-speed memory costs (GDDR7, HBM)

Production and Distribution Bottlenecks

- Yield rates and defect costs at advanced manufacturing nodes

- Global semiconductor supply chain disruptions continuing

- Packaging and assembly capacity constraints

- Retailer markup requirements and distribution costs

Corporate Strategy and Profit Maximization

The crypto boom changed everything. And companies liked the profits.

Crypto Era Market Conditioning

Remember 2021 and 2022? Graphics cards cost $800+ for mid-range models. People paid for it because crypto miners would buy anything.

Then crypto crashed. Prices should have dropped, right?

Wrong.

Companies got used to those fat profit margins. They saw people pay $800 for a card that used to cost $300. Why go back?

Here’s what happened to your wallet:

- $800+ became the new normal for mid-range cards

- Companies raised profit expectations permanently

- You got psychologically conditioned to accept high prices

- Budget options disappeared to force you into expensive tiers

They trained you to think that expensive is normal.

Deliberate Pricing Psychology

Want proof this is intentional? Look at the warehouses.

Companies have unsold inventory sitting around. Cards that aren’t selling at current prices. Do they lower prices? Nope.

They’d rather store cards than sell them cheap. Why?

Because lowering prices would reset expectations. You’d expect reasonable prices again.

The strategy is clear:

- Keep prices high even with poor sales

- Quarterly profit reports matter more than moving inventory

- Eliminate budget options so you buy expensive cards

- Train consumers to accept inflated pricing

It’s working. You’re still buying.

Companies would rather sell fewer cards at higher profits than more cards at reasonable prices.

Market Structure and Competition Issues

You have two real choices for graphics cards. That’s the problem.

Duopoly Pricing Power

Nvidia and AMD control the market. Intel Arc exists, but it’s stuck in budget territory with limited options.

This means no real competition where it matters:

- Mid-range cards: Nvidia sets the price, AMD matches it

- High-end cards: Same story, different price bracket

- Budget cards: Intel competes, but barely makes a dent

AMD used to undercut Nvidia’s prices. Not anymore. Why sell for less when people will pay Nvidia prices?

It’s called price leadership. Nvidia raises prices. AMD says, “Sounds good,” and follows along.

You lose. They both win.

Artificial Scarcity and Market Manipulation

Here’s where it gets sneaky.

Companies could make more cards at MSRP. They choose not to. Limited production creates panic buying.

The playbook works like this:

- Announce an attractive MSRP to generate hype

- Produce tiny quantities at that price

- Watch scalpers buy up the limited stock

- Retailers abandon MSRP after the first shipment

Remember graphics card launches? “Sold out in seconds” every time.

That’s not an accident. It’s strategic scarcity.

Retailers get 50 cards instead of 5,000. You panic. You pay higher prices for “in-stock” alternatives.

Consumer Market Impact

The pricing games hurt real people. Here’s how bad it’s gotten.

Pricing Cascade Effects

Remember when you could get a decent graphics card for $300-500? Those days are over.

The mid-range market disappeared. Companies stopped making cards in that price range. Why? Because they can force you to spend more.

Here’s your new reality:

- $300-500 range: Almost nothing available

- “Budget” cards: Now cost $400+

- High-end cards: $1000+ is the new normal

- Used market: Inflated because new cards cost too much

You used to have choices. Now you have expensive and more expensive.

Think about what this means for your wallet.

A card that should cost $350 doesn’t exist. Your options are $200 (weak performance) or $600+ (decent performance).

No middle ground.

Companies killed the sweet spot on purpose. They want you to spend more money.

The used market got hit, too. Why?

People can’t afford new cards. They bid up used prices instead. A three-year-old card that should cost $150 now goes for $300.

Everyone loses except the companies.

Your gaming budget just got squeezed from both ends.

Conclusion

Graphics card prices aren’t coming down anytime soon. AI demand, corporate greed, and lack of competition created this mess.

Companies learned they can charge premium prices, and you’ll pay them. The crypto boom proved it. Now they’re prioritizing profits over gamers.

Your best options? Buy used, wait for rare sales, or consider older-generation cards. Don’t expect MSRP pricing to return.

The market changed. Companies like the profits too much to go back.

Until real competition emerges or demand shifts, you’re stuck with inflated prices. Plan your budget accordingly.

That’s the reality of GPU shopping in 2025.

Frequently Asked Questions

Why do GPU manufacturers prioritize AI over gaming customers?

AI customers pay 5-10x more per chip, buy in bulk quantities, and offer predictable enterprise contracts versus volatile gaming demand.

Will competition from Intel lower GPU prices significantly?

Intel Arc targets the budget segment only, lacking the high-end competition needed to pressure Nvidia/AMD’s premium pricing in most segments.

Why don’t manufacturers produce more cards at the actual MSRP pricing?

Limited production of MSRP cards creates scarcity, forcing consumers toward higher-margin “premium” variants with identical performance but fancy cooling.

Are the high manufacturing costs justifying current GPU prices?

Partially yes for cutting-edge nodes, but profit margins have expanded significantly beyond manufacturing cost increases since the crypto era began.

Why do AMD cards cost nearly as much as Nvidia, despite being marketed as alternatives?

AMD adopts a price-following strategy rather than undercutting, preferring higher margins on fewer sales over aggressive market share competition.